Start with three concrete actions this week: book an annual physical, set a monthly retirement transfer equal to 15% of gross pay, and schedule a 90‑minute planning talk with your partner to align priorities. Track progress using three KPIs: net worth change, average weekly exercise minutes, and sleep onset latency. Aim to reach a measurable 15% improvement in at least one KPI within 12 months; execute one micro‑task each day to avoid waste of momentum.

If youre experiencing an unpredictable emotional response, introduce short interventions: four 10‑minute breathing sessions weekly, 150 minutes of moderate activity per week, and 2.5 liters of water daily. These steps are compact, evidence‑aligned and usually reduce reactivity within 6–8 weeks. For monitoring, record morning mood on a 1–5 scale and compare monthly to see concrete shifts in feeling and emotional regulation.

Career and side projects benefit from clearer prioritization: list five tasks and delegate or stop two, then reclaim those hours for strategic work or personal time. If you run a business, set a 20% delegation target for routine tasks this quarter and document time reclaimed in hours per week. Many people find the whole process liberating; coaches said small delegation gains free capacity for higher value work and for relationships in which you and a partner both thrive.

Social and household patterns change with intention: schedule one uncancellable Sunday morning per month for family or hobbies, set an inbox cutoff at 7pm, and move one recurring subscription to a trial period before renewal to trim overspending. Common fears arent permanent; incremental boundary setting strengthens confidence and makes living on purpose more feasible. Practically, if youve prioritized five real wants over the next 24 months, you create permission to say no to low‑value commitments.

Embrace concrete milestones to measure progress: a new certification within 18 months, three meaningful conversations per quarter, or a savings buffer equal to three months of fixed expenses. These targets improve how your years unfold, help you feel more confident in decisions, and reveal simple goodness in day‑to‑day choices. Keep a compact journal for finding patterns in thinking and behavior, and use it as proof you can reach specific outcomes while keeping priorities aligned with how your lives are actually lived – small actions produce wonderful, whole changes.

How Turning 40 Translates Into Real-Life Advantages

Allocate 15% of gross income to retirement accounts and keep six months of expenses in cash; within a year youve built flexibility to accept a higher-risk job, start a business or buy a home.

Most are glad when measurable moves–automated savings, one certification, a single negotiation–produce visible gains; review decisions made this year and reallocate recurring spend to investments or skill training.

- Finance: Automate 15% contributions (pre-tax or Roth), maintain a 6-month emergency fund, target retirement assets equal to ~3x salary by mid-40s; audit subscriptions monthly so you do not waste cash on low-return items.

- Careers: Create a 12-month skills plan with three priorities that increase pay or scope; when negotiating, youd ask for a written title change plus a 10% raise; employers recognize depth and seriousness at this stage.

- Health: Order an annual blood panel (lipids, A1c, CMP), schedule baseline womens screening per clinician advice, and book dental twice a year; aim for 150 minutes moderate exercise weekly and 2–3L water daily for metabolic and skin benefits.

- Appearance: Apply SPF 30+ daily, introduce retinol progressively, use targeted filler for deep wrinkles, and consider a mini lift when sag becomes noticeable; these steps give a younger, natural result with limited downtime.

- Home & assets: Evaluate purchase vs rent using 20% down as a benchmark; owning reduces rent exposure and creates a platform for a side-business or rental income–weigh tradeoffs between stability and mobility.

- Mindset & productivity: Use accumulated wisdom to prioritise high-leverage activities; compare opportunities side-by-side to see which deliver both income and health gains rather than repeating the same low-return tasks.

- Relationships & network: Focus on two strong connections and pruning peripheral ties; finding someone who supports career moves reduces stress and improves outcomes, and hiring a paid mentor speeds progress when thinking about pivots.

One practical thing to implement this month: cancel unused services, redirect 10% of saved cash to an index fund and 10% to a targeted skills course aligned with your careers plan; maybe use a small portion to book a consultation for appearance or health screening if youve delayed them.

Compared to younger peers, your experience and recognized competence shift bargaining power; if youre thinking a pivot is risky, note data shows pivots after mid-30s succeed when paired with measurable skill gains–use that edge to make the best next move.

Use Financial Stability to Build a Low-Risk Emergency Fund and Increase Retirement Contributions

Move six months of verified essential monthly expenses into low-risk vehicles and raise retirement deferrals by 1 percentage point each quarter until you hit 15–20% of gross pay or your employer match plus 10 percentage points.

Calculate essentials precisely: list rent/mortgage, utilities, groceries, insurance, minimum debt service and childcare; sum equals core monthly expense. Example: core = $4,200 → 6-month reserve = $25,200. Keep a separate spreadsheet column for irregular annual costs like property tax and vehicle maintenance to avoid underfunding.

Allocate the reserve across instruments: 60% in a high-yield savings account with daily liquidity, 25% in a 3–6 month Treasury bill ladder, 15% in 6–12 month no-penalty CDs or institutional money market funds. Reinvest matured ladder rungs into the ladder to preserve yield while keeping access. Move windfalls (bonuses, birthday gifts, blog revenue) to the fund before discretionary spends.

Retirement mechanics: enroll to receive full employer match immediately; automate increases via payroll change or plan auto-escalation. If current deferral is 6%, schedule +1% per quarter until 15–20% target. When you get a raise, divert half of the net increase into retirement contributions. If over age 50, add catch-up provisions available in your plan.

Risk controls: cap emergency-fund exposure to market volatility by avoiding long-term bonds or equities; keep no more than 10% of the reserve in low-volatility bond funds for slightly higher yield. Review liquidity needs every 12 days after major household changes like marrying, adding a child or moving. Rebalance the ladder after major withdrawals.

Use a clear priority order for cash flows: 1) employer match, 2) build six-month reserve, 3) hit 15% retirement target, 4) pay down high-interest debt (>7%), 5) taxable investing or philanthropy. If a huge unexpected expense happens, draw from the HYSA first, then the shortest maturing ladder rung.

Behavioral tactics: set two automated transfers each pay period – one to HYSA for the reserve, one to the 401(k)/IRA. Label accounts plainly so your partner or mate and their advisers see purpose. Tell a trusted friend or financial mate your step goals; accountability increases follow-through and reduces emotional spending after a big birthday or during stressful days.

Tax and product notes: prefer Roth deferrals if your effective marginal rate is low and you look to lock tax-free growth; choose traditional if current marginal rate is high and you should lower taxable income. Consider short-term Treasury funds for slightly higher yields without the operational complexity of buying direct bills, once you have a custody account open.

Practical examples and language you can use with advisers: “I request payroll deferral +1% quarterly until contributions reach 18% of gross; direct half of any bonus to my emergency HYSA.” Be honest about irregular expenses you learned from past years, including childcare costs, healthcare deductibles and annual subscriptions. A simple story of a friend who paid for a ruined vacation sunscreen incident will help colleagues look seriously at reserves.

Soft considerations: philanthropy can resume after establishing reserves and contribution targets; maybe allocate 1–2% of income to causes you recognize as meaningful. If shes managing household finances or your partner is the primary saver, align both contributions to avoid duplication. Financial stability looks like predictability of cashflow, healthy buffers and a plan you could explain in plain words to a child or a mate when asked what to receive from your accounts in an emergency.

Leverage Industry Experience to Negotiate Higher Pay or Move into Consulting

Ask for a 10–25% base salary increase within 30 days, presenting three quantified projects (revenue uplift, cost reduction, retention delta), an external comp benchmark, and two client references; if the employer stalls, propose a 90‑day performance addendum with a clear KPI payout.

When you talk to hiring managers, lead with outcomes: show which decisions were made, late‑stage optimizations delivered, and the delivery phase metrics – companies are mostly focused on measurable impact, thats where you win leverage. Prepare a 2‑page dossier with baseline, delta, and ROI (%), so there is enough evidence to remove any hiring worry and remove subjective debate.

For a consulting pivot, price hourly and project packages explicitly: target a daily rate equal to 1/150 of your desired annual compensation, build a 12‑week pilot priced to receive a 20–30% margin, and list deliverables as milestones. If you’ve been thinking about an exit from corporate, skip another generic interview and sell a pilot to one outside client first; treat the pilot like a short movie with script, cast, budget and deliverables to make onboarding easy.

Document what you learned from prior roles: most examples from your twenties show learning curves, rather than repeatable outcomes, while recent projects demonstrate repeatability. Use simple case tables (metrics, time, role, client) and include references who can confirm work quality – they care about credibility more than glossy branding.

| Path | Target | Timeline | Required Evidence |

|---|---|---|---|

| Negotiate Salary | 10–25% increase or equity | 30 days for proposal, 90 days for performance addendum | 3 quantified projects, market comp, 2 references |

| Internal Promotion | Role regrade + 15–30% comp uplift | 6–12 months with quarterly checkpoints | Roadmap, stakeholder signoffs, projected KPIs |

| Consulting Pilot | Daily rate = desired annual/150 | 12 weeks pilot, 6 months repeatable pipeline | Pilot deliverables, case study, client testimonial |

Use negotiation scripts with two anchors (low concession, high ask) and practice talk points aloud; having rehearsed language reduces hesitation and makes closing easy. If you are married or single, living arrangements and ages influence risk tolerance – many professionals realized in later ages that smaller financial experiments make them happier and reduce worry about aging responsibilities.

Finally, measure outcomes quarterly, collect another case study after each engagement, and ask to receive written feedback within 14 days of delivery; the goodness of repeatable results is visible to C‑suite buyers and offers the most direct route to higher compensation or steady consulting revenue.

Prioritize Health: Which Screening Tests to Schedule and How to Plan Weekly Movement

Schedule these tests now: annual blood pressure, fasting lipid panel every 4–6 years (sooner if LDL >130 or family history), fasting glucose or HbA1c annually if BMI ≥25 or every 3 years if normal, comprehensive metabolic panel every 1–2 years, TSH if symptomatic or family history, Pap/HPV per current intervals (Pap alone q3y or co-test q5y), colon cancer screening beginning at 45 for average risk (colonoscopy q10y or FIT annually), skin check yearly if any atypical moles, baseline mammogram discussion at 40 with annual or biennial timing agreed with your clinician based on risk, and consider baseline PSA discussion at 45 for high-risk men. Write down dates, results, and next due dates; bring that list to appointments to keep everything prepared.

Get these objective numbers checked: blood pressure target <130>

Weekly movement plan to hit guideline targets: total 150 minutes moderate aerobic activity or 75 minutes vigorous per week PLUS two strength sessions. Practical schedule example: Monday 30 min brisk walk (RPE 6), Tuesday strength 30 min (2–4 sets of 6–12 reps: squats, push-ups, bent-over rows, Romanian deadlifts), Wednesday 20–30 min intervals (5×2 min hard/2 min easy), Friday strength 30 min (single-leg work, overhead press, plank variations), Saturday 45–60 min outdoor activity (hike, bike) to get vitamin D and mood benefit. Add daily 10–15 min mobility/yoga focused on hips, thoracic spine, and ankle dorsiflexion.

Progression and intensity guidance: increase total weekly volume by ~10% every 2–3 weeks, add 1–2 reps per set or 2–5% load on compound lifts when you can complete target reps with good form. Use talk test or heart-rate zones: moderate = can speak in full sentences, vigorous = short sentences only. Track sessions in a simple spreadsheet or app so youd see trends; if performance stalls for >3 weeks, schedule a clinical check and reassess sleep, stress, and nutrition.

Special considerations based on personal history: if marie or any person has family cancer history, autoimmune disease, or early heart disease, request earlier or more frequent screening and referrals to specialists. Women with premature menopause, steroid use, or low BMI may need DEXA scans before typical ages; men with new urinary symptoms get a PSA discussion. If youre afraid of procedures, ask for sedation options or FIT testing alternatives where appropriate–being prepared reduces barriers.

Mental and practical tips: set one non-negotiable step per day (10-minute walk, one strength exercise) so habit formation gets traction; schedule screenings into work calendars and allow a backup appointment within two weeks. Read clinic portals and printed results the same day you get them so small abnormalities arent ignored. Outdoor activity gives measurable mood lifts and improves sleep; aim for at least two outdoor sessions weekly.

Use this checklist before each annual visit: meds and supplements list, family history updates by ages and conditions, vaccination record, recent labs and imaging, exercise log, and specific questions you want answered. This approach reduces hard-to-track stuff, keeps clinicians efficient, and gives a clearer picture of where changes get made in the next phase of health and happiness.

Set Clear Personal Boundaries: Ready Phrases for Saying No and Managing Obligations

Use short, explicit refusals with an offered alternative or a firm time boundary: e.g., “I can’t take this on now; I can help next Tuesday.”

- One-line no’s (fast, polite):

- “Thank you – I can’t commit at this time.”

- “I’m booked; I need to pass.”

- “I don’t have capacity right now.”

- Work-specific scripts:

- “I can’t add this to my plate without delaying my current deadline; suggest asking Olivia or delegating.”

- “I’ll finish the priority items first; if you want this next, we can schedule it between 3–4pm.”

- Family & friends:

- “I love you and can’t join this weekend; I’ll be there next month.”

- “I won’t be able to host, but I can contribute dessert or help with setup.”

- Partners & intimate requests:

- “I want to be honest: I need an evening to recharge; can we move this to Saturday?”

- “I’ll join after I’ve had a two-hour break so I’m fully present.”

Deploy these management rules to reduce overcommitment:

- Set a weekly capacity number (hours or tasks). Track actual time; compare forecast vs. real each Sunday.

- Adopt a 24-hour response rule for non-urgent asks: use a short hold message, then accept or refuse.

- Use a visible calendar block labeled “focus/restore” to stop last-minute requests.

- Assign or outsource repetitive tasks; pick two people you can ask for help – both internal and external partners.

Quick boundary-reset phrases when pressured:

- “I said no earlier; my position hasn’t changed.”

- “I feel pulled – I’ll step back and return with an answer on Friday.”

- “I can’t do this under current circumstances; if conditions change, I’ll let you know.”

How to negotiate without guilt:

- Swap time for value: offer a shorter version or a paid option.

- Be specific about trade-offs: “I can do X in 30 minutes, or Y in 2 hours.”

- Use evidence: log past overloads and show how lesser demands improved outcomes.

Practical daily habits to enforce boundaries:

- Block a daily “reset” of 30–60 minutes for rest or research; protect it as non-negotiable.

- Write a two-sentence refusal template and save it in your notes for fast replies.

- After saying no, do one small restoring action (walk, read, call Lisa) to reduce stirring guilt and restore peace.

Examples using the required words in context:

- “I appreciate the invite – thank you; I’m honoring my whole weekend for rest.”

- “I’ve done research and found many tasks can be split between two people.”

- “Some women prefer concise refusals; others benefit from explaining the reason briefly.”

- 저는 이야기했던 한 여성, Olivia, 말했다. '싫다고 말하는 것은 그녀의 자존감을 높이고 사랑하는 사람들이 그녀의 시간을 존중하도록 도왔습니다.'

- 이 짧은 대본들을 읽고, 마음에 드는 두 개를 골라 필요하기 전에 연습하세요.

- 사실은 분명합니다. 시간을 되찾는 것은 장기적인 과부하를 줄이고 더 큰 역량을 창출합니다.

- 솔직하게 말하세요 – 당신의 평화를 해치는 작업보다 우선순위를 두는 업무가 있다면 파트너와 동료에게 알리세요.

- 긴급하고 중요한 업무 사이에 중요한 것을 선택하십시오. 나중에 위기가 줄어들 것입니다.

- 의무가 진정으로 중요하게 생각하는 것과 일치할 때 어떤 선함이 돌아온다.

- 누군가가 밀어붙인다면, ‘그것에 약속할 수 없습니다. 이해해 주셔서 감사합니다.’라고 말하세요.

- 동의하기 전에 먼저 달력을 확인하고 자문해 보세요: 이 요구는 제가 주고 싶지 않은 에너지를 소모하게 할까요?

- 많은 상황에서 위임하는 것이 균형을 되찾는 가장 빠른 방법입니다.

- 몇 가지 간단한 거절은 사랑하는 일과 새로운 우선순위에 대한 연구를 위해 긴 시간대를 보호할 수 있습니다.

- 일부 특별한 요청은 긍정하는 가치가 있고, 일부는 그렇지 않습니다. 죄책감이 아닌 가치에서 결정하십시오.

- 역량에 대한 솔직함은 파트너, 친구, 동료가 더 잘 계획하는 데 도움이 됩니다.

- 선의는 의무가 실제 가용성과 기술에 부합할 때 증가한다.

- 사랑하는 동료 Lisa, 저녁 시간을 차단하고 알림을 끄면서 더 큰 평화를 찾았습니다.

- 무엇보다 중요한 것은 도움을 요청할 수 있는 사람들의 짧은 목록과 소리 내어 읽을 수 있는 거절 템플릿 몇 가지를 준비해 두는 것입니다.

매일의 선택을 간소화하세요: 의사 결정 피로를 줄이고 저녁을 되찾을 수 있는 간단한 루틴

세 가지 저녁 메뉴를 선택하여 월요일~금요일로 교체합니다. 구운 닭고기, 연어 시트 팬, 채식 파스타; 일주일에 두 번 90분 세션으로 단백질을 대량 조리하고 채소를 한 번 미리 썰어 놓으면 - 이 간단한 조작 하나로 저녁 식사 결정을 밤에 대략 12개에서 3개로 줄이고 추가적인 노력 없이 저녁 시간을 약 45분 동안 사용할 수 있게 됩니다.

아홉 벌의 옷으로 이루어진 캡슐(상의 3벌 × 하의 3벌)을 만들고 주 2회 세탁 일정을 계획하세요. 부부의 경우 협상을 줄이기 위해 색상 구역을 지정하고, 학교, 직장, 헬스장 맞게 공유 체크리스트를 따르며, 예기치 못한 계획을 위해

30분 기술 사용 중단 시간을 설정하고 수동적인 시청 대신 고정된 정리 루틴으로 대체하세요: 10분 가벼운 스트레칭, 10분 독서, 10분 감사 노트 작성. 수면을 추적하는 경우 화면을 침실에서 치우고 7일 동안 취침 시간을 기록하여 수면 지연 시간 및 다음 날 집중력 향상을 측정하세요.

단일 결정 규칙을 사용하여 매일의 논쟁을 없애세요. 기본 저녁 식사, 기본 통근 경로, 기본 팁 비율을 선택하세요. "뭐 먹고 싶어?"라고 물으면 달력이나 미리 설정된 규칙을 가리키세요. 논쟁이 없습니다. 자녀나 돌봄 책임이 있는 가구의 경우, 2주 주기로 돌아가면서 책임을 할당하여 모두가 책임을 맡는 일이 예정된 주에 맡는다는 것을 알도록 하세요. 즉흥적인 호출이 아닌 예약된 주에.

전통에 깊이 뿌리내린 조부모님의 의식을 운영 모델로 채택하세요: 주간 준비, 핀보드 메뉴, 예비 키를 위한 병 – 전통적인 패턴은 미세한 선택을 줄입니다. 자선과 같은 개인적인 우선순위에 대해 매월 기부 슬롯 하나를 달력에 표시하고 의사 결정 증가를 피하기 위해 기부를 자동화하세요. 지난 시즌에 효과적이었던 이야기를 수집하고, 연도별 결과를 비교하고, 간단한 지표를 사용하세요: 주당 회복된 분. 저녁 시간이 이정표라고 생각되면 14일간 테스트를 실행하고, 절약한 시간을 기록한 다음, 성공적인 부분을 다음 시즌의 일상으로 만드세요 (출처: 소규모 가정 실험은 의사 결정 과부하에 대한 명확한 행동 증거를 제공합니다).

9 Benefits of Turning 40 – Good Things That Happen in Life">

9 Benefits of Turning 40 – Good Things That Happen in Life">

Codependency in Relationships – Signs & Recovery Tips">

Codependency in Relationships – Signs & Recovery Tips">

I Love My Boyfriend but Is It Time to Break Up? 10 Signs & How to Decide">

I Love My Boyfriend but Is It Time to Break Up? 10 Signs & How to Decide">

우리는 같은 사람을 만나는 걸까요? 온라인 그룹의 어두운 면">

우리는 같은 사람을 만나는 걸까요? 온라인 그룹의 어두운 면">

Can I Be Loved If I Don’t Like Myself? Self-Esteem & Relationships">

Can I Be Loved If I Don’t Like Myself? Self-Esteem & Relationships">

Is Texting Cheating? Text Cheating on Facebook Explained">

Is Texting Cheating? Text Cheating on Facebook Explained">

3 Effective Messages to Send a Woman with No Bio on a Dating App">

3 Effective Messages to Send a Woman with No Bio on a Dating App">

Why People Behave Badly on Dating Apps – Causes, Psychology & Solutions">

Why People Behave Badly on Dating Apps – Causes, Psychology & Solutions">

Why Men Don’t Ask Questions – Single Woman’s Guide">

Why Men Don’t Ask Questions – Single Woman’s Guide">

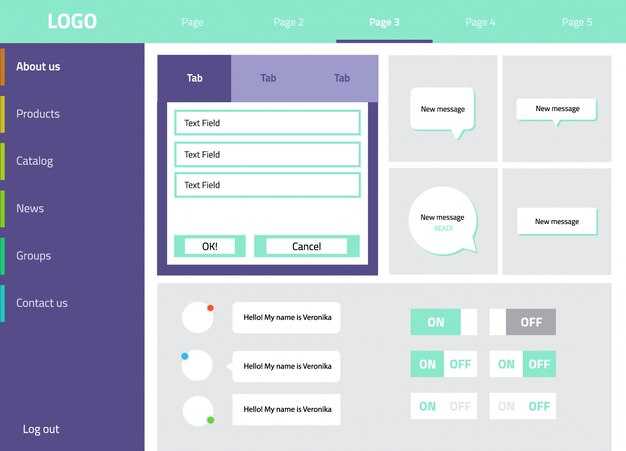

Dialog Window – UI Design, Examples & Accessibility Best Practices">

Dialog Window – UI Design, Examples & Accessibility Best Practices">

관계 의존 극복 – 벗어날 수 있는 실용적인 조언">

관계 의존 극복 – 벗어날 수 있는 실용적인 조언">