Introduction

Luxury matchmaking services cater to high-end clients seeking a personalized and discreet approach to finding a long-term partner. Unlike mainstream dating apps, these services offer human matchmakers, curated introductions, and white-glove support – at premium prices. In the United States, the luxury matchmaking market has gained significant momentum in recent years. Singles frustrated with swipe culture and concerned about privacy are increasingly turning to elite matchmakers. This report provides a detailed overview of the U.S. luxury matchmaking industry. It includes market size and growth, key players and new entrants, market drivers, client demographics, service models, and the marketing strategies used to attract affluent clientele. All findings are supported by recent data, industry reports, and expert commentary.

Market Overview: Size, Growth, and Trends

Market Size and Growth: The U.S. dating services industry (which includes online dating, matchmaking, and related services across price tiers) was estimated at $9.27 billion in 2024 and is projected to grow to $13.4 billion by 2030. Within this space, the premium/luxury matchmaking segment is booming, significantly outpacing average industry growth. One analysis projects the premium matchmaking market nearly doubling from $1.27 billion in 2023 to $2.39 billion by 2032 globally, reflecting strong demand for high-touch services.

Growth rates in the matchmaking sector are in the mid-to-high single digits annually. For example, the overall matchmaking market (online and offline) is expected to grow around 5.8% CAGR through 2032. Top luxury firms are exceeding these benchmarks. For instance, Selective Search reported double-digit revenue growth in 2025, outperforming a 5.8% industry projection by 72%. This surge signals a robust and expanding market for upscale matchmaking.

Trends Shaping the Industry

Several trends underpin the rise of luxury matchmaking in the U.S.:

Dating App Fatigue

After a decade of “swipe” apps, many singles (across age groups) feel dissatisfied with algorithm-driven dating. Nearly half of U.S. adults say dating feels harder today than 10 years ago, and “app fatigue” is at an all-time high. Users are burned out by ghosting, superficial matches, and safety concerns on apps. This disillusionment has led to a renewed appetite for human matchmaking and face-to-face connections. In fact, in-person dating events and singles mixers jumped 51% in 2024, with 71% higher attendance than prior years.

High-Net-Worth Individuals Seeking Personalization

The growth of the high-net-worth population in the U.S. provides a larger client base for luxury matchmakers. The U.S. added about 562,000 new millionaires in 2024, bringing the total to approximately 7.9 million HNWIs (individuals with ≥$1M in investable assets). These affluent singles often have extremely limited time and a strong desire for privacy. For them, time is the ultimate luxury and they prefer to “outsource” the partner search to experts. As one industry observer noted, busy wealthy professionals already outsource tasks like personal training, travel planning, and household management. That, in turn, rises a question – “why not outsource finding love, which is highly salient?”. This mindset, coupled with rising numbers of HNW singles, is a major driver for elite matchmaking services.

Personalization and Human Touch

In an era of AI and automation, luxury matchmaking’s humancentric approach is a selling point. Clients expect a highly customized experience – something algorithms alone haven’t delivered . Matchmakers emphasize rigorous vetting, deep personal interviews, and “quality over quantity” in matches. Selective Search’s CEO highlighted that personalization is everything for high-net-worth clients. Their surge in demand reflects singles “no longer content settling for AI-driven apps or impersonal services”. In practice, this means matchmakers spend hours getting to know clients’ values and goals, hand-select matches, and provide ongoing coaching. The result is a high-touch, boutique service that stands in stark contrast to the self-service dating app model.

“Love as an Investment” Mindset

Culturally, paying substantial fees for help in finding love has become more normalized among affluent Americans. As one media piece noted, “what was once a swipe-based time-killer is now a full-on investment – both emotionally and financially”. Singles are treating matchmaking fees as any other personal investments, expecting a return in the form of a lasting relationship. This willingness to invest is buoyed by success stories and the diminishing stigma around seeking professional help to find a partner. Indeed, the old taboo about “using a dating service” has faded, especially in elite circles, where efficiency and results are prized.

Resilience Amid Economic Woes

Interestingly, high-end matchmaking appears resilient even during economic uncertainty. Luxury matchmakers have reported thriving business despite recession fears. The ultra-wealthy tend to continue spending on personal services like matchmaking regardless of downturns – viewing love and companionship as essential. Bloomberg News in mid-2025 noted that elite dating services are thriving as love defies economic woes. Firms are seeing growing demand from singles seeking more meaningful connections away from apps. In short, the pursuit of love (for those who can afford it) is seen as recession-proof. This, in turn, contributes to the industry’s strong growth trajectory.

Key Industry Players and Competitors

The U.S. luxury matchmaking landscape features a mix of established firms and newer entrants. Each of them has its own approach and niche. Selective Search – founded in 2000 by Barbie Adler in Chicago – is often cited as the nation’s leading luxury matchmaking firm. However, there are numerous competitors and boutique agencies operating at the high end. Below is a comparison of several prominent players, their differentiators, and, where available, their claimed success rates and pricing:

Prominent Matchmaking Services and Their Figures

Matchmaking Service | Founded (HQ) | Claimed Success Rate | Distinctions | Typical Fees |

| Selective Search – Nation’s largest luxury matchmaker | 2000 (Chicago, IL) | 89% of clients enter a relationship | Executive search-style rigor; 4,000+ couples matched to date; human over algorithm focus | ~$25,000 to $250,000 packages (depending on scope of search) |

| Kelleher International – Elite global matchmaker for ultra-wealthy | 1986 (San Francisco, CA) | 87% of clients “find love” (many leading to marriage) | Family-run (motherdaughter team); celebrity and CEO clientele; global network of scouts | ~$30,000 to $300,000 per year (per 2022 reports) |

| LUMA Luxury Matchmaking – Nationwide boutique firm | 2010 (Minneapolis, MN) | 87% of clients enter relationships | Network of matchmakers across U.S.; offers coaching, image consulting; personalized vetting | $0 to ~$150,000 (free database option for nonclients; fullservice packages up to six figures) |

| Janis & Carly Spindel Serious Matchmaking – “Rolls-Royce” of matchmakers | 1993 (New York, NY) | 5000+ marriages arranged since founding (no % given) | Mother-daughter duo; men are clients and women join free as potential matches; ultra-exclusive global VIP service | $75,000 basic retainer; global VIP packages $1M+ |

| Three Day Rule – Modern matchmaking for professionals | 2013 (Los Angeles, CA) | 84% client satisfaction (their metric for success) | Tech-enabled matchmaking (uses algorithms + human matchmakers); partners with apps (formerly Match.com); popular with younger professionals | ~$5,900+ to start (pricing often $5–$15K range for multimonth packages) |

| Tawkify – Hybrid online + personal matchmaking | 2012 (San Francisco, CA) | 80% find success within first 12 matches | Matches clients via a nationwide pool using human matchmakers and a proprietary platform; more affordable, subscription-oriented model | ~$4,000–$8,000 for 3–6 month plans (positioned as a mid-range service) |

| It’s Just Lunch – Long-running dating service for busy professionals | 1991 (Chicago, IL) | Not publicly disclosed (focus is on setting up first dates) | Over 30 years in business; arranged 2+ million dates ; operates via franchise in many cities; caters to professionals for casual lunch dates | ~$1,000 to $5,000 per package (per client reviews; varies by region and number of matches) |

| Others / Niche Firms – e.g. Linx Dating, Exclusive Matchmaking, Select Date Society, Agape Match, Perfect 12, Vida Select | Various (often major cities) | Varies by firm (many don’t publicize rates) | These boutique firms often serve specific niches: geographic (Silicon Valley, etc.), demographic (religion, LGBTQ, age focus), or ultra-high-end celebrities. They differentiate via personalized service and networks. | Fees generally in the five to six figures for highend, bespoke searches (e.g. Agape Match ~$18K–$100K; Perfect 12 $60K–$250K; etc.) |

New Entrants and Emerging Models

Beyond the well-known companies above, new matchmaking concepts are appearing to capitalize on the demand for human connection.

Some startups blend matchmaking with private social events. For example, Singles Only Social Club (launched 2023) hosts curated singles mixers as an “analog” alternative to apps. Others, like MyTruBond in Texas, combine an app with in-person mixers for a “white-glove” experience focused on facilitating offline meetings. These new entrants often target younger professionals and try to lower the barrier to entry (sometimes starting with free sign-ups or event tickets). They still emphasize human matchmaking elements (background checks, personality assessments, etc.) but may not charge the same premium as traditional elite matchmakers.

Notably, even Gen Z clients are starting to hire matchmakers. One luxury firm (Three Day Rule) reported a 400% surge in clients age 27 and under. A lot of young adults are delete dating apps in favor of personal matchmaking. This is virtually unprecedented and suggests a potential future demographic expansion for the industry.

What Can Be Noted

Despite new models, the incumbents maintain an edge through their extensive databases of pre-screened singles and reputations built over decades. Many high-end matchmakers rely heavily on referrals and word-of-mouth in affluent circles. For example, it’s common for happy couples who met through a service to refer friends or even have the matchmaker attend their weddings (a networking opportunity and endorsement rolled into one).

Overall, the competitive landscape is characterized by a high level of personalization and relatively low client volume per matchmaker. This means that multiple firms can thrive by carving out their niche (by region, clientele type, or matching philosophy) without directly “commoditizing” the market.

The table above highlights that while success rates are often touted (in the ~80–90% range for top firms). These figures are usually self-reported and defined differently by each company. Clients are advised to understand how each firm defines success – whether it’s a first date, a relationship, or a marriage – as the industry lacks a standardized metric.

Market Drivers and Consumer Insights

Dissatisfaction with Traditional Dating Methods

A primary driver of luxury matchmaking’s growth is frustration with mainstream dating options.

An increasing number of affluent singles view popular dating apps as time-wasters that often yield fleeting or superficial encounters. Over 65% of new selective matchmaking inquiries since 2019 have come from men fed up with “endless conversations that go nowhere” on apps. Professional matchmakers offer a solution by vetting matches and eliminating the noise, which appeals to those who feel burnt out.

Moreover, safety and authenticity are concerns: high-profile individuals worry about fake profiles, scammers, or privacy breaches on apps. A 2024 survey noted that affluent singles had significant privacy concerns on digital dating platforms, given highly publicized data leaks. For a CEO or public figure, appearing on a dating app can even be “embarrassing” or risky if employees, clients, or tabloids discover their profile. Luxury matchmaking addresses these issues by operating with strict confidentiality and extensive screening, providing a sense of security that online platforms cannot.

Rise of High-Net-Worth Singles

Demographic shifts are also at play here. The number of wealthy singles in their 30s, 40s, and beyond has grown. Among the factors are focusing on careers longer, high divorce rates among affluent couples, and overall wealth creation. These individuals often prioritized education and career in their 20s and 30s. And now these people found themselves with means but without a partner. Their busy lifestyles leave little time to meet new people organically.

As mentioned, the U.S. now has nearly 8 million millionaires and saw a 7.6% increase in HNW population in a recent year. This expanding pool of financially successful singles is predisposed to seek premium services. They are accustomed to paying for convenience and expertise in other domains, and apply the same logic to their personal lives. Sociologists observe that wealthy clients approach matchmaking with a “money buys results” mentality. They believe that a high fee will equate to a higher-caliber match and a better outcome. While paying more doesn’t guarantee true love, the perception that it will “buy a better product” drives many to give elite matchmakers a try.

Also, HNW singles tend to value discretion and control. Hiring a matchmaker offers a sense of control over the process (having a dedicated professional working on their behalf) and discretion (matches are introduced privately, not in the public eye), which is very appealing to this group.

Personalization and Success Rates

Another driver is the promise of higher success in finding a compatible partner through personalization. Matchmakers often tout high success rates, as shown in the table above (generally 70–90% by their definition). While these statistics are not audited, they create a powerful marketing message that clients have a much better chance at a serious relationship with a matchmaker than on their own.

For instance, Selective Search advertises an industry-leading 89% success rate , which resonates with goal-oriented individuals. The process itself is tailored: clients undergo extensive interviews (often 2–3 hours long) about their values, past relationships, and goals. Matchmakers then use databases and proactive “headhunting” to find matches that meet detailed criteria, including personality fit and life goals, not just looks or proximity. This meticulous approach is labor-intensive but yields matches that clients often describe as more compatible and serious than what they found via apps or chance.

One client explained that by using a matchmaker, “you multiply the time you’d spend dating by your hourly rate, and the fees suddenly become not so bad… I value my time, and I’m serious about finding the right person.” This sentiment captures why busy high-earners are willing to invest in the process.

Changing Attitudes and Psychographics

The luxury matchmaking clientele today spans genders more than in the past.

Traditionally, many elite matchmakers only accepted male clients (with a large database of women who join for free). They are operating on the assumption that affluent men would pay to be introduced to attractive, compatible women. That model still exists. For example, Janis Spindel’s firm only has men as paying clients (women can be added to their pool after vetting). Likewise, Agape Match in NYC enrolls women for free while men purchase packages.

However, more successful women are now proactively hiring matchmakers for themselves as well. Firms like Selective Search and Kelleher take on female clients and have noted an uptick in high-achieving women (executives, entrepreneurs, etc.) who want the same discreet help in finding a partner that men have historically sought.

Clientele’s Age

In terms of age and life stage, most luxury matchmaking clients are in their 30s to 60s – established people. Many went through a divorce or have had previous long-term relationships, though some are ultracareer-focused individuals who postponed marriage.

The emerging trend of some younger clients (late 20s) using matchmaking has been noted, but the core demographic remains older millennials, Gen X and young Baby Boomers with means. These clients are typically well-educated, career-oriented, and financially secure. Psychographically, they value privacy, efficiency, and expertise. They often cite that they “have no trouble getting dates, but struggle to find the right person” – hence they turn to matchmakers to refine the search. They also tend to be individuals who invest in self-improvement and quality in other areas (from fitness trainers to luxury travel), so investing in a “curated love life” feels like a natural extension of their lifestyle.

As one UHNW advisory report put it, for wealthy singles, delegating the partner search to a trusted service “makes perfect sense”. It saves them time and reduces the risks of public dating.

Seeking Lasting Relationship

Finally, a notable driver is the desire for genuine, lasting relationships as opposed to casual dating.

High-end matchmaking explicitly markets itself as being for finding marriage or long-term partnership, not flings. This resonates with clients who are serious about settling down. Matchmakers often set ground rules and expectations accordingly. For example, Janis and Carly Spindel emphasize they “don’t do arm candy, don’t do trophy wives, don’t do gold diggers” – clarifying that their service is about authentic compatibility, not superficial pairings. This messaging attracts clients who are tired of the transactional feel of app dating and want a more meaningful connection.

The end result is a clientele that is highly motivated and committed to the process. That in turn drives the high success rates (since both parties introduced are usually serious about a relationship).

Service Structures

Luxury matchmaking is characterized by personalized service and premium pricing. While each firm has its own approach, there are common elements in how services are structured:

Membership Model

Most elite matchmakers operate on a membership or retainer model. Clients pay an upfront fee for a package that typically spans a set time period (often 6 or 12 months) or a guaranteed number of introductions.

For example, Selective Search’s packages range from $25,000 up to ~$250,000 for an ultra-exclusive search. Kelleher International’s contracts (per media reports) range $30,000–$300,000 for a one-year membership.

At the very top end, global VIP searches can cost $1M+ (as with Janis Spindel’s highest tier). On the lower end of the “luxury” spectrum, services like It’s Just Lunch cost closer to $1,000–$5,000 for a limited number of matches. Meahwhile, Three Day Rule starts around $5,900 for a base package.

In all cases, fees are typically paid upfront and are nonrefundable, regardless of outcome. Although reputable firms will often pause a contract or work with a client longer if a match hasn’t been found in the contracted period. Pricing often depends on search scope – a local/regional search is cheaper, while a nationwide or international search with more dedicated resources can command a much higher fee.

Client vs. Database Member Distinction

A common industry practice is maintaining a large database of non-paying members who can be matched with paying clients. Many services allow individuals (often women in hetero matchmaking) to join the roster for free as potential matches, after screening. The client then is paying for then matchmaker’s effort to select and vet from this pool to find their match.

For instance, women can apply to be considered for matches at Selective Search at no cost, whereas the men who engage the service pay the fee. Agape Match and Janis Spindel’s Serious Matchmaking follow this model as well.

This structure ensures matchmakers always have a pipeline of candidates for clients, and it also serves as a marketing tool (many free members eventually convert to paid clients if they want more agency in the search).

High-Touch Process

The service structure is very hands-on and personalized. Once a client signs on, they are assigned a dedicated matchmaker (or a small team) who will work closely with them.

The process usually starts with a deep interview or questionnaire, covering everything from basic preferences (age, religion, desire for kids) to finer details (lifestyle, values, personality traits sought). Many firms also incorporate professional assessments – some do personality tests, others have psychologists on staff, and almost all perform background checks on matches for safety.

After onboarding, the matchmaker searches for potential matches. This search can involve querying the firm’s internal database, leveraging personal networks, and even proactive recruiting (some matchmakers will literally cold-approach or LinkedIn message potential matches who fit the criteria). If the client agrees, the matchmaker will arrange the date (often handling all logistics – choosing a venue, coordinating schedules).

After introductions, feedback is gathered from both the client and the match. Top firms emphasize this post-date feedback loop as a key to refining the search. For instance, the matchmaker will debrief the client about what they liked or didn’t, and also often get input from the match about the client’s dating presentation. This feedback is used to coach the client if needed (“Next time, maybe talk less about work,” etc.) and to adjust matchmaking strategy going forward. The inclusion of date coaching and image consulting is common in luxury packages. The idea is to not only find candidates, but also prepare the client to be successful when meeting them – something apps or lesser services don’t provide.

Duration and Guarantees

Most engagements last around 6 to 12 months of active matching (with a set number of introductions attempted in that time). Some services offer guaranteed number of matches (e.g. “at least X matches or we extend your search”). Others simply commit to working on the client’s behalf for the term, with no specific number of introductions promised (especially if the criteria are very narrow).

Because matchmaking is as much art as science, no ethical service guarantees marriage or love – in fact, credible matchmakers explicitly avoid any “guarantee of marriage” in their contracts. What clients are paying for is the matchmaker’s time, network, and expertise to vastly improve their odds of finding a compatible partner.

Many firms will put a search on hold (for example, if a client starts dating someone exclusively during the contract, they might freeze the service) and resume if that doesn’t work out, to ensure the client gets the full value of the service time.

Success Metrics and Follow-up

As discussed, success metrics vary. Some count a match as successful once the client enters a committed relationship (this is the case for LUMA and Selective Search’s published rates). Others use client satisfaction surveys or count engagement/marriage.

The lack of standardization means that when a firm advertises “X% success,” it requires a closer look. For instance, one firm’s 95% success could mean 95% of clients went on at least one date, whereas another’s 80% might mean 80% got into a long-term relationship. Consumers are encouraged to ask how success is defined. Despite these nuances, the overarching service structure is designed to produce quality matches that have a high likelihood of leading to a relationship.

Many firms will proudly share their raw outcomes: e.g. Selective Search cites 4,000+ happy couples and an A+ Better Business Bureau rating as proof points, and Janis Spindel’s team cites over 5,000 marriages from their introductions. These figures double as marketing for the service model’s effectiveness.

Pricing Models

As the table highlighted, pricing in this industry is premium. Here are some common pricing model features:

Tiered Packages

Firms often have tier levels. For example, a local search vs. national search vs. international search can be tiers, or a basic package vs. exclusive VIP package with the difference being how many matchmakers work on the case and how broad the search is. The cost can escalate into six figures for top tiers. Perfect 12’s founder noted her company starts at $60,000 for local and goes up to $250,000 for all-inclusive global searches. Janis Spindel’s range ($75k to $1M+) also reflects search scope and level of personalization. Selective Search’s $25k entry package versus $250k elite package similarly denotes different levels of service (the highest levels might include the founder’s direct involvement or unlimited matches). Tiered pricing allows matchmakers to cater to merely wealthy clients as well as ultra-wealthy clients under the same brand.

Membership Duration

Typically, the fee buys a certain duration of active matchmaking (often a year). Some services will continue introducing beyond the term until a match is found, but formally the contract has an end date. “Hold” policies are common – if a client meets someone promising early, they can pause the service, and if that match doesn’t lead to a committed relationship, the service can resume without extra charge (within some limit). This flexibility is part of the service promise (matchmakers want success stories as much as clients do).

No Success Fee (Usually)

Interestingly, most matchmaking firms charge a flat fee rather than a contingency or success fee. The rationale is that the effort is expended regardless of outcome. And charging upfront ensures the client is committed to the process. A few boutique “headhunter of hearts” style matchmakers might have a portion of fee due upon engagement or marriage, but that’s not the norm at the luxury level – the norm is pay in full for access to the service. However, some lower-end matchmaking companies or dating coaches might work on a per-match or monthly subscription basis (e.g. Tawkify offers a monthly payment plan in some cases, which can be canceled with notice). The luxury segment mostly avoids pay-per-date because it could incentivize matchmakers to give quantity over quality.

Value-Added Services

The price often includes ancillary services. For instance, many packages include date coaching sessions, image consulting (styling, professional photos), or even makeovers. Three Day Rule has offered photo shoots and profile makeovers as part of some packages. Some high-end matchmakers provide concierge services – Simona Fusco of Perfect 12 mentioned helping clients with travel planning for romantic trips and even real estate advice when couples decide to move in together. These extras are meant to cater to the holistic needs of a wealthy client who expects full-service. It also justifies the high cost by going beyond just matching to improving the client’s readiness for a relationship.

Database-Only Option

A notable pricing feature is that many firms allow people to join their database for free or a nominal fee. This means you won’t be an active paying client with guaranteed matches, but you might be contacted if you fit what someone is looking for. LUMA, for example, explicitly states their services range from $0 (to be in the database) up to $150k for full service . This dual model ensures a large pool of candidates. It’s essentially a freemium model: if you are an attractive candidate (in terms of match criteria), you might get matched to a paying client without paying. But if you want a matchmaker to search on your behalf, you become the paying client. It’s worth noting that some individuals start as a free member (being matched to someone else), then later decide to become a paying client themselves if they don’t find success passively.

Overall

In summary, the luxury matchmaking service model is highly personalized and relationship-driven, with pricing that reflects the intensive labor and low volume (a matchmaker might only handle a few clients at a time, especially at the very high end). The cost can be justified for clients by the time saved, the increased probability of finding a compatible partner, and the intangible benefit of having an expert guide them in a very important life decision. As one industry piece quipped, singles have started viewing matchmakers as a combination of headhunter, coach, and concierge for their love lives. This encapsulates why the model commands premium fees and continues to attract those who can afford it.

Marketing and Branding Strategies

Luxury matchmaking firms use carefully crafted marketing and branding strategies to appeal to high-end clientele. Unlike mass-market dating apps that advertise broadly, elite matchmakers take a more targeted, reputation-based approach. Here are key strategies and examples:

Emphasizing Success and Social Proof

A central message in all branding is “we deliver results.” Major firms highlight the number of marriages or long-term relationships they’ve facilitated. For example, Selective Search frequently cites its 89% success rate and over 4,000 happy couples as proof of their effectiveness.

Kelleher International publicizes that it was responsible for “hundreds” of marriages and even was voted #1 by certain outlets. By showcasing these outcomes, they tap into the high-end client’s desire for a service with a proven track record. Many sites have testimonial stories or even press releases announcing client engagements (anonymized, often).

The use of statistics like “9 out of 10 clients find a relationship” is meant to justify the hefty price tag and instill confidence that the service works. However, as noted, firms may define success differently – so part of the marketing is also educating prospects on what that success metric means.

For example: Selective Search defines success as a committed relationship, not just a date). Still, bragging rights in terms of success are a major marketing tool. Firms will also highlight any third-party validation: e.g. “A+ Better Business Bureau Rating,” awards (Selective Search was named “Best Luxury Dating Service in Chicago 2025” by a business magazine ), or media features (being featured in Forbes, WSJ, etc. lends credibility).

Branding as Elite, Exclusive Services

The language and imagery used by these companies aim to position them as exclusive clubs or premium consultancies rather than dating websites. Janis Spindel famously said, “We’re considered the Rolls-Royce of matchmaking. We’re not a dating service… we help our clients find a long-term partner.”

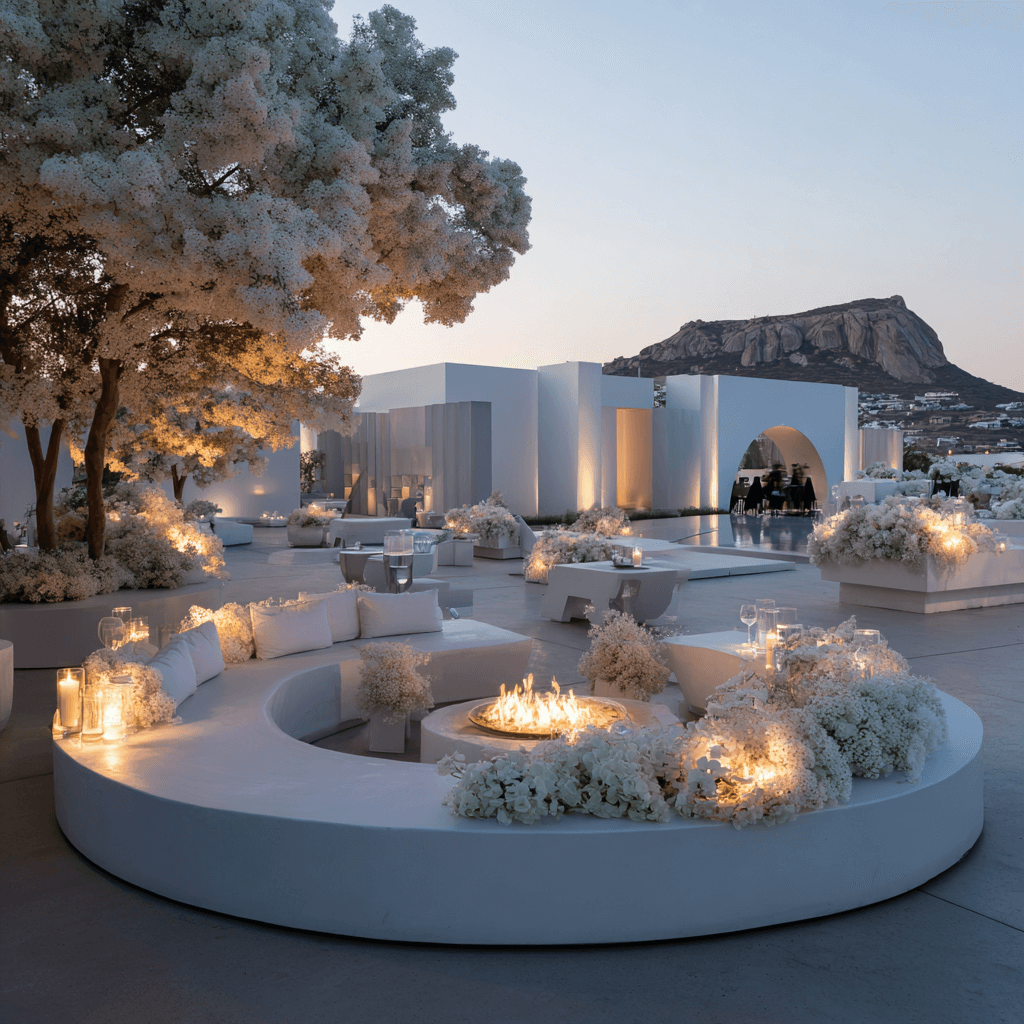

This distinction is important in branding – they distance themselves from “dating services” or apps, and instead align with luxury brands (Rolls-Royce in that quote) and professional services (executive search, relationship experts, etc.). Many firms use terms like “boutique,” “private matchmaking,” “executive search for the heart,” and “elite introductions.” The visual branding often features imagery of successful, attractive professionals, luxury lifestyle cues (upscale cityscapes, elegant couples at dinner, etc.), and a polished, confidential aesthetic. The idea is to convey discretion, sophistication, and personal attention. A firm like Select Date Society even uses “society” to evoke a selective club.

Similarly, The League (dating app) when it launched a matchmaking concierge service, leaned heavily on exclusivity (accepting only a limited number of clients). Luxury matchmaking websites typically require an application or offer a phone consultation rather than letting you sign up and pay instantly – reinforcing that “not everyone is accepted”, which paradoxically makes affluent clients want it more.

Thought Leadership and PR

Many matchmaking CEOs and founders engage in public relations by providing expert commentary on dating and relationships in the media. This serves to both normalize their services and establish them as experts worth paying for. It’s common to see matchmakers quoted in articles about dating trends (e.g. commenting on “dating app fatigue” or giving tips for finding love in mid-life). For instance, in the Wired article, Tawkify’s chief matchmaker spoke about the deeper issues with app dating and how matchmakers help people relearn how to connect. Such quotes simultaneously plug the company and educate consumers that there is an alternative to apps. Matchmakers also appear on morning TV shows or podcasts as relationship experts. This strategy builds brand authority and trust.

Other Means of Marketing

Word-of-Mouth and Referrals

In a luxury service business, referrals are gold.

Matchmakers cultivate referrals by delivering excellent service and then encouraging happy clients to refer friends or give testimonials (some anonymous). High-end clients often run in tight social circles, and if one person finds success with a matchmaker, their friends or colleagues take note.

The UHNW Insights article mentioned that matchmakers often attend the weddings of their clients – a visible reminder to those at the wedding of who made the match. Those impressed by the outcome may become clients. Discretion is key, so they won’t reveal details without permission, but stories of “my friend used X matchmaker and is now happily married” are powerful marketing.

This strategy relies on client satisfaction and trust, which is why the process is so service-oriented. A happy client not only means success, but potentially more clients via their network.

Digital Marketing and SEO

Unlike dating apps that advertise on billboards and social media to the masses, luxury matchmakers use more targeted digital marketing. Many have invested in content marketing – for example, LUMA and Vida Select maintain blogs with titles like “How to Choose a Matchmaker” or “Dating in Your 40s: Tips from a Matchmaker,” which are SEO-optimized. These articles (often lightly disguising promotion) draw in educated professionals searching for alternatives to online dating.

Tawkify’s blog that ranks top matchmaking services is another example – it provides useful info (and incidentally ranks Tawkify highly) to capture search engine traffic from people researching matchmakers. Paid search is also used; a Google search for “luxury matchmaker NYC” will yield ads or top results from firms who know their clientele often find services via Google.

Distinct Value Propositions

Each major player tries to differentiate slightly in branding.

For instance, Selective Search leans into its founder’s executive recruiting background – branding its process as the “Executive Search of matchmaking,” implying a level of professionalism and rigor akin to hiring a C-suite executive.

Three Day Rule positions itself as a modern matchmaker that’s friendly to tech/startup culture – noting its partnerships and its appeal to younger clients.

Vida Select (which offers a form of hybrid matchmaking/online dating management) markets itself on flexibility and that it can even run your dating app profiles for you, combining tech and human help.

It’s Just Lunch has long marketed around convenience for professionals. In summary, branding messages orbit around: exclusivity, success, personalization, and professionalism, but each firm will emphasize the facet that aligns with its origin story or target niche.

Educational Marketing

Because matchmaking (especially at high price points) is a considered purchase, firms often employ educational marketing to nurture potential clients. This includes seminars, webinars, or free consultations that don’t hard-sell but inform.

For example, some matchmakers host “dating mindset” webinars or publish e-books on finding love. By giving advice freely, they build trust and demonstrate expertise. Many luxury matchmakers also speak at wealth management events or luxury lifestyle conferences – places where potential clients (or those who advise them, like wealth managers or personal concierges) might be.

The UHNW Insights site itself is an example of content aimed at advisors, framing matchmaking as a growing trend for the wealthy. When wealth advisors view matchmakers as a legitimate resource for their clients, they may recommend them – functioning as another referral channel.

Client Experience as Marketing

Finally, the client experience itself is part of the branding. These services strive to deliver such a white-glove, satisfying experience that even if someone doesn’t find their soulmate immediately, they are impressed enough to speak positively about the service. High end clients expect top-notch service (think: responsiveness, feeling “understood” by their matchmaker, little touches like a check-in call before a big date, or a congratulations gift when a match turns into an engagement).

Matchmakers often become quasi-friends and confidantes to clients. This relationship-building means even those who don’t find love will often say, “the service was professional and worth it, we just didn’t find the one yet.” In an industry built on trust, reputation is everything. Negative word-of-mouth can be fatal in luxury circles. Firms work hard to keep clients satisfied and maintain an impeccable image.

Overall

In conclusion, marketing luxury matchmaking is about selling an experience and an outcome that is profoundly personal. These companies position their services as exclusive solutions for discerning individuals. They reinforce that message through success stories, privacy, and tailored care. As a result, they attract clients who have both the means and the motivation to invest in finding love.

As more success stories emerge and media coverage highlights the thriving elite matchmaking scene, the stigma continues to fade. The idea of hiring a matchmaker becomes almost a status symbol itself. The industry has moved far from its old image as a last resort. Today, it represents a smart and proactive choice for people who refuse to rely on chance or algorithms. This reframing, combined with strategic outreach and an emphasis on discretion and results, has allowed luxury matchmaking firms in the U.S. to capture a growing and lucrative market.

Conclusion

The luxury matchmaking industry in the United States is experiencing robust growth. It is fueled by shifting attitudes in modern dating and an expanding pool of affluent singles seeking bespoke solutions. With the U.S. dating services sector forecast to reach over $13 billion in the coming years, high-end matchmakers are carving out a significant and growing niche. Key players like Selective Search, Kelleher International, LUMA, and others have honed service models that blend the efficiency of executive recruiting with the intimacy of personal coaching – delivering something uniquely compelling in today’s technology-weary dating landscape.

Several factors underlie the success of luxury matchmakers. Market drivers such as frustration with impersonal dating apps, a desire for privacy and safety, the “time is money” ethos of high-net-worth individuals, and the willingness to invest in finding a partner all strongly work in favor of the matchmaking model. Consumer demographics skew toward older, successful professionals, but the client base is diversifying as younger generations recognize the value of human help in dating. These clients are united by a profile of being proactive, discerning, and valuing quality over quantity in their relationships – traits which matchmakers cater to by providing highly personalized matches and guidance.

The competitive landscape is populated by both venerable firms with decades of experience and agile newcomers offering innovative twists (such as curated events or hybrid app-matchmaking approaches). While competition is growing, demand appears to be growing even faster – leaving room for multiple firms to flourish. Each differentiates itself through success stats, unique philosophies, or specific clientele, but all emphasize a human-centered, concierge-level service that contrasts sharply with mainstream dating options.

Looking ahead, trends indicate sustained momentum for the luxury matchmaking industry. The continued rise in affluent individuals, combined with the normalization of outsourcing personal matters, bodes well for demand. As technology plays an ever larger role in daily life, the value of genuine human connection and personalized experiences has, somewhat counterintuitively, increased. People are seeking refuge from digital overload in services that put the human element front and center. Luxury matchmaking sits at the intersection of this desire for real connection and the ability to pay for a solution. Additionally, these services have shown resilience even in uncertain economic times, suggesting a degree of immunity to market fluctuations.

In conclusion, the U.S. luxury matchmaking market is robust and evolving. It is a market defined not by sheer volume, but by high-value, high-impact transactions – each successful match can mean a lifechanging outcome for the individuals involved.

The industry’s growth to date has been driven by delivering on a promise that resonates with many singles today: that a personalized, human approach can cut through the frustration of modern dating and lead to lasting love. The market rests on solid fundamentals, which leads to key players continually innovating their services. At the same time, cultural fatigue with purely algorithmic dating is growing. As a result, luxury matchmaking is set to remain an important and expanding part of the U.S. dating landscape. At the same time, cultural fatigue with purely algorithmic dating is growing. That, in turm, sets luxury matchmakers to remain a significant (and growing) part of the U.S. dating landscape. For those who can afford it, matchmaking has become the ultimate bespoke service – one that just might yield the ultimate return on investment: a happy, enduring partnership.

Sources:

- Selective Search 25th Anniversary Press Release (GlobeNewswire, Dec 2025)

- Business Insider, “High-earning men are ditching dating apps for $25,000 matchmakers” (Oct 2025)

- Moneywise/Yahoo Finance, “$24K to meet her husband — luxury matchmaking ROI?” (May 2025)

- Wired, “Can Matchmaking Platforms Save Us From Dating App Fatigue?” (Mar 2025)

- UHNW Insights, “Why are wealthy singles turning to elite matchmaking services?” (Sep 2025)

- LUMA Luxury Matchmaking Blog, “Matchmaker Success Rate: Breakdown of Top Firms” (Jun 2025)

- The Cut, “Professional Luxury Matchmaker Services for Millionaires” (Feb 2023)

- Tawkify Blog, “Top 12 Professional Matchmaking Services (2024)”

- DatingNews, “Matchmakers Report 400% Surge in Gen Z Clients” (Aug 2025)

- Pew Research Center – Online Dating Reports (cited via Wired and UHNW Insights)

- Capgemini World Wealth Report 2024 (HNW population data)

Links

- ‘It Was Worth Every Penny’: One Woman Confesses to Shelling Out $24K To Meet Her Husband —

As Luxury Matchmaking Services Grow, Are Singles Getting a Sufficient Return on Their Investment?

(https://moneywise.com/life/lifestyle/worth-every-penny-one-woman-confesses-to-shelling-out-24k-to-meet-her-husband-luxurymatchmaking- services-grow-are-singles-getting-a-sufficient-return-on-their-investmen) - High-Net-Worth Men Ditch Apps for $25,000 Matchmaking — Here’s Why – Business Insider (https://www.businessinsider.com/high-net-worth-men-ditch-apps-expensive-matchmaking-heres-why-2025-8)

- Matchmaking Service Market Report | Global Forecast From 2025 To 2033

(https://dataintelo.com/report/matchmaking-service-market) - Selective Search Closes Out 25th Year With Tremendous

(https://www.globenewswire.com/news-release/2025/12/09/3202493/0/en/Selective-Search-Closes-Out-25th-Year-With-Tremendous-Growth-Thanks-to-Continued-Commitment-to-Human-Element-in-Matchmaking.html) - Can Matchmaking Platforms Save Us From Dating App Fatigue? | WIRED

(https://www.wired.com/story/dating-apps-rise-of-matchmaking-platforms/) - What Does High Net Worth Mean in 2025 For Retirement?

(https://shpfinancial.com/what-does-high-net-worth-mean-in-2025-retirement/) - Why are wealthy singles turning to elite matchmaking services? – UHNW Insights

(https://uhnwinsights.com/why-are-wealthy-singles-turning-to-elite-matchmaking-services/) - Elite Dating Services Are Thriving as Love Defies Economic Woes

(https://www.bloomberg.com/news/articles/2025-06-24/elite-dating-services-are-thriving-as-love-defies-economic-woes) - Matchmaker Success Rate: A Breakdown Of The Top Firms

(https://lumasearch.com/blog/matchmaker-success-rate/) - Top 12 Professional Matchmaking Services (2024): Cost & More | Blog | Tawkify

(https://tawkify.com/blog/dating-methods/best-matchmaking-services) - How Much Does LUMA Matchmaking Cost? – Reddit

(https://www.reddit.com/r/LUMAMatchmakingReview/comments/1g3opd6/how_much_does_luma_matchmaking_cost/) - The Professional Luxury Matchmaker Services for Millionaires

(https://www.thecut.com/article/professional-luxury-matchmaker-services-millionaires.html) - Matchmakers Report 400% Surge in Gen Z Clients

(https://www.datingnews.com/industry-trends/matchmakers-seeing-increase-in-gen-z-clients/) - Professional Singles – Selective Search

(https://www.selectivesearch.com/professional-singles/) - Selective Search: Best Luxury Dating Service in Chicago 2025

(https://theceovision.com/selective-search-elite-matchmaking/) - The Million-Dollar Matchmaking Firm Trusted by the Ultra-Wealthy

(https://selectdatesociety.com/blog/why-so-many-billionaires-outsource-their-dating-life-to-hidden-agencies) - LUMA Luxury Matchmaking Review 2025: Pricing, Pros/Cons, What to Expect

(https://blog.photofeeler.com/luma-luxury-matchmaking/)