Set a fixed agenda and treat the meeting as a decision session: state net income, fixed commitments, and a saving target up front. Limit each meeting to one decision point so conversations stay focused and create less friction; if a new issue pops up, assign a follow-up rather than extending the session.

Use a simple structure: split inflows with a clear method (example: 60% bills, 20% saving, 20% personal) or adopt an income-based contribution so contributions scale with earnings. Automate rent and two credit cards, cap shared discretionary spending at a preset threshold, and keep a $1,000 buffer for knock events. Track numbers monthly and log any windfalls or big purchases so youve a record of decisions and progress; looking back at that log reveals trends and opportunities.

Specify three short-term actions and one long-term goal: emergency fund target, a 6–12 month debt-reduction plan, and a long-term plan tied to a dream (home, retirement). amanda said theyre making a shift to a shared sub-account: theyre contributing $250 each monthly and report a 6% reduction in discretionary spend – that test could become a stable habit together. Collect concrete ideas, note potential friction points, assign small tasks if one partner lacks budgeting experience, and agree whether anyone is willing to increase contributions as income grows.

Start your money conversations with a short, structured first meeting

Book a 30-minute first meeting with a visible timer and this three-item agenda: (1) 5 minutes – list balances, debts and card accounts; bring printed statements, images or screenshots and three index cards labeled “needs”, “wants”, “shared”; (2) 10 minutes – review recurring charges, decide who covers which cards and agree whether to consolidate small debts; (3) 15 minutes – set a concrete emergency fund target and a starter dream fund contribution, decide amounts toward each, and schedule one concrete next step. They should bring recent PDFs or login screenshots if needed and a calculator.

Set simple ground rules up front: speak with honesty, be honest about subscriptions and spending, keep remarks open and specific, no interruptions, and no checking phones during the meeting. Allow a single time-out card if anxieties spike; if someone said “I’m worried,” pause and ask what numbers would reduce that worry. Silence isnt the same as agreement and silence doesnt mean consent; a short clarifying question at each point prevents misunderstandings and keeps the tone from getting very tense.

End with three concrete outputs that show progress: a one-page summary that lists who pays which bills, the amount left after essentials and what goes toward the emergency and dream funds, and an automatic transfer schedule; a decision on what to do with any money left; a 15-minute weekly check to confirm plans are working and to address leftover questions. Instead of rehashing blame, focus on maintaining trust across accounts and on simple math-based rules that sound fair – this isnt a game. Maybe rotate responsibility for checking statements so no one feels shame; remember to set a calendar invite and a short agenda so plans are always visible and both keep looking forward rather than getting stuck in old anxieties.

Schedule a 15-minute check-in: choosing time, place, and tone

Schedule a recurring 15-minute slot on both calendars (example: Wednesday 8:00–8:15 PM); title the invite “15‑min check-in: accounts & plans” and attach the latest spreadsheet.

- When: pick one fixed window – weekday evening (8:00–8:15), Sunday morning (10:00–10:15) or weekday lunch (12:00–12:15). Choose weekly if debts or significant changes are likely; biweekly or monthly if cash flow is stable.

- Where: neutral, low-distraction spots – kitchen table, living room couch, a short walk, or the parked car for privacy. Avoid the bedroom for emotionally loaded conversations.

- Tone: factual + one emotional check. Rules: (1) no interruptions, (2) one “I” statement about feelings, (3) focus on accounts and next steps, not on past mistakes.

- 0:00–0:02 – quick status: who has checked balances and whether the shared spreadsheet was produced since last meeting.

- 0:02–0:07 – checking accounts vs budget spreadsheet: update balances, note any unexpected withdrawals, and flag mistakes to correct.

- 0:07–0:11 – near-term obligations: list upcoming rent, college payments, large purchases, debts or subscription changes and their cost.

- 0:11–0:13 – emotional pulse: each person names one feeling (vulnerability, shame, resentment acceptable) and one sentence on why it matters for planning.

- 0:13–0:15 – actions: assign one clear task, who does it, deadline, and where to record completion in the spreadsheet; agree next check-in time.

Concrete agenda items to include in the invite: link to the spreadsheet, a list of shared accounts, manual entries for recent significant transactions, and a one-line summary of any debts added or paid off.

- If a knock or interruption happens, pause and reschedule within 48 hours; do not convert the meeting into a confrontation.

- Frequency rule: choose weekly when cumulative unexpected costs or new debts exceed 10% of monthly income; otherwise use a monthly cadence.

- Assign roles: one person maintains the spreadsheet produced for the meeting, the other verifies bank totals; rotate this part monthly to reduce blind spots.

Sample opening lines to reduce defensiveness: “I’m thinking we should check accounts and flag any changes,” or “I want to say what I see without blame.” Close with one sentence connecting decisions to a shared dream or future goal to keep emotional stakes constructive.

Prepare three facts to share about your finances and two questions to ask

State three specific facts:

Fact 1 – monthly cash flow: net take‑home $5,200; fixed bills $2,300 (mortgage $1,200; utilities $300; insurance $200; subscriptions and everyday expenses $600); discretionary spend $400; automatic savings $300. Emergency cushion = five months of fixed bills → target $11,500. Having this figure ready prevents vague estimates and moves the conversation into numbers.

Fact 2 – debts and assets: mortgage principal $210,000; student loans $28,000; credit card balance $3,200; liquid assets $35,000; retirement assets $85,000; net assets ≈ −$116,000 (assets minus liabilities). Note any help from parents, co‑signers, or shared accounts that affect those totals.

Fact 3 – exposure and plans: college fund $12,000; insurance gaps identified across health and disability; risk tolerance: low; worst‑case playbook: pause nonessential contributions, use liquid assets, sell one noncritical asset if headcount of monthly bills exceeds runway. Use Amanda as an example: amanda reduced risk by redirecting $200/month from dining out into an emergency fund, which covered three months of bills after a job loss.

Ask these two direct questions:

1) Which priority should we tackle together first: paying down mortgage principal faster, building the five‑month cushion, or funding college – and what part of our monthly cash flow should follow that choice?

2) If one of us loses income for more than three months, what worst-case steps are you comfortable taking (cutting everyday spending, using liquid assets, selling assets, asking parents for short‑term help)?

Keep answers numeric and concrete, invite open notes or a shared spreadsheet so issues are visible rather than vague, and aim for a simple connection plan that gets both people comfortable enough to get things out of their head and onto paper.

Use a one-page checklist to cover income, recurring bills, and debts

Create a one-page checklist that records combined net income, each recurring bill (name, amount, due date, autopay status), and every outstanding debt (minimum payment, current balance, interest rate); produce this as a printable PDF and a simple spreadsheet produced from the same source, update it on the first of every month, and keep the printed copy on the fridge and the digital copy in a shared folder.

Set clear thresholds and ownership so decisions are straightforward: assign a primary owner for each line item and a backup; flag any recurring bill that exceeds 10% of combined net income or any debt with interest above 12% for immediate review; another rule: if a late notice can knock two or more payments off schedule, escalate to a joint call within 48 hours. If someone is struggling, move bills into short-term planning that reduces cost or pauses nonessential subscriptions.

Run five quick checks each month: 1) verify total recurring cost vs net income, 2) confirm autopay and contact info, 3) reconcile last payment amounts against bank statements, 4) note any coming one-off expenses (insurance, taxes) and 5) confirm contingency balance (aim for three months of household expenses). Keep the checklist factual to avoid emotional disputes; focus on whats quantifiable so you can think through trade-offs together.

Implement immediately: produce the initial version in 20–30 minutes using the column headers below, circulate for signatures, and set a recurring calendar reminder for reviews. Columns: Item | Owner | Amount | Frequency | Due Date | Autopay (Y/N) | Account | Min Pay | Balance | Interest | Notes. This system could raise clarity fast, reduce luck-based decisions, prevent common mistakes people make after they started living together, and keep images of an ideal dream aligned with what actually lives in your bank accounts.

Agree on a follow-up date and one measurable outcome for the next meeting

Set a follow-up exactly 30 days from today and name one measurable outcome: reduce combined monthly variable spend on utilities and groceries by 10% versus the trailing three-month average (baseline: utilities $420, groceries $360), with the partner who pays utilities responsible for weekly reporting.

Choose an outcome that is specific and auditable: examples include consolidating many accounts into two active accounts, increasing retirement contributions by $200/month, building an emergency fund equal to 3 months’ income, or documenting all assets held across personal and business records. Pick the single metric that will lead progress and produce clear checks – variance in dollars, number of accounts closed, or contribution dollars added; record who started each task and which areas need help.

Discuss the chosen topic openly and record evidence produced during planning: spreadsheets, transaction images, screenshots of accounts or bills. Keep one open folder with dated files so nothing is left in your head; confirm youre comfortable with the metric and timeline to avoid future resentment. Sometime before the next meeting, each person should send a short update that shows progress and flags other issues (romance budget, utilities split, irregular income, business invoices) so the meeting can stay focused on the agreed metric.

| Date | Measurable outcome | Lead | Base de referencia | Objetivo | Evidencia |

|---|---|---|---|---|---|

| 2025-12-15 | Reducir el gasto variable (servicios públicos + alimentos) | Alex (responsable de finanzas) | Servicios $420, Comestibles $360 (promedio de 3 meses) | Reducción de 10% ($72 total) | Hojas de cálculo semanales producidas, imágenes de facturas, extractos de cuentas bancarias |

Registra las decisiones de forma sencilla: dónde guardar las notas y cómo volver a consultarlas

Utilizar una única Hoja de cálculo de Google compartida titulada “Decisiones del hogar” como registro principal: las columnas deben incluir Decisión, Resumen en una línea, Propietario, Fecha de la decisión, Fecha de revisión, Costo estimado, Estado y Enlace a los detalles; establecer derechos de edición para ambos miembros de la pareja y proteger las filas finalizadas para que las entradas sigan siendo claras y auditables.

Guarda el material de apoyo donde mejor encaje: adjunta imágenes o PDFs de recibos a la hoja de cálculo o a una carpeta compartida enlazada, guarda las explicaciones largas y las notas de las reuniones en un documento de Google o en una página de Notion, y utiliza una hoja de cálculo para los gastos y los objetivos de ahorro de modo que puedas graficar el progreso; si a uno de los miembros de la pareja le enseñaron a guardar los recibos en papel, escanéalos e incorpóralos a la carpeta compartida.

Establezca reglas de cadencia y recordatorios: revisiones rápidas mensuales para facturas y pagos a corto plazo, trimestrales para objetivos como ahorro y planes relacionados con los niños, y revisiones anuales para compromisos importantes; cree invitaciones de calendario para cada fecha de revisión e incluya una agenda de una línea en el evento para que tenga una lista de verificación lista cuando comience la reunión.

Definir propiedad y etiquetas: asignar un único propietario para las actualizaciones, una etiqueta de “discutido” cuando un punto se haya dialogado, una etiqueta de “tentativo” durante las decisiones iniciales y una etiqueta de “serio” para las elecciones vinculantes; señalar quién estaría dispuesto a tomar medidas y quién probablemente necesite más tiempo para que los seguimientos sean más rápidos que renegociar desde cero.

Plantilla directa para entradas y conclusiones rápidas: Decisión = “Quién paga el cuidado de niños”; Resumen = “Dividir 60/40 hasta el final del año escolar”; Responsable = nombre; Fecha = 2025-06-01; Revisión = 2025-09-01; Estimación de costes = $X/mes; Enlace a notas = URL. Este formato crea una conexión clara entre la decisión, la razón y los siguientes pasos, lo que hace que compartirlas y revisarlas sea correcto e ideal para la coordinación a largo plazo.

Cómo Hablar Sobre Dinero en Tu Relación – Consejos Prácticos">

Cómo Hablar Sobre Dinero en Tu Relación – Consejos Prácticos">

Codependency in Relationships – Signs & Recovery Tips">

Codependency in Relationships – Signs & Recovery Tips">

I Love My Boyfriend but Is It Time to Break Up? 10 Signs & How to Decide">

I Love My Boyfriend but Is It Time to Break Up? 10 Signs & How to Decide">

Are We Dating the Same Guy? The Dark Side of Online Groups">

Are We Dating the Same Guy? The Dark Side of Online Groups">

Can I Be Loved If I Don’t Like Myself? Self-Esteem & Relationships">

Can I Be Loved If I Don’t Like Myself? Self-Esteem & Relationships">

Is Texting Cheating? Text Cheating on Facebook Explained">

Is Texting Cheating? Text Cheating on Facebook Explained">

![3 Mensajes Efectivos para Enviar a una Mujer Sin Bio en una App de CitasHave you ever stumbled upon a profile on a dating app that's… sparse? Like, really sparse? No bio, maybe a couple of pictures, and you're left wondering, “Is this a bot? A ghost? Or just someone who believes in letting their pictures do the talking?”While a lack of information can be intriguing (a mystery!), it can also be a hurdle when it comes to sparking a connection. You don't have much to work with, so you need to be creative and strategic with your opening message.Here are 3 effective messages to send a woman with no bio on a dating app, along with explanations of why they work:**1. The Observational Opener**This approach focuses on something you *did* notice about her profile – her photos. It shows you paid attention and allows you to start a conversation based on shared interests or a vibe you picked up.*Example:* "Hey! Love the [location in one of her photos]. Been there myself! What’s your favorite thing to do in [location]?”*Why it works:* It's low-pressure, shows you’re observant, and provides an easy conversation starter.**2. The Playful Curiosity Approach**If you’re feeling a bit bolder, you can lean into the lack of information with a playful question. This shows you're not afraid to be a little cheeky and invites her to share something about herself.*Example:* "No bio, huh? Clearly, you're a woman of secrets. 😉 What’s one thing you’re surprisingly good at?”*Why it works:* It’s lighthearted, breaks the ice, and demonstrates a sense of humor.**3. The Direct & Engaging Question**Sometimes, simplicity is key. Ask an open-ended question that encourages her to elaborate and reveals a bit about her personality.*Example:* "What's one thing that's made you smile today?”*Why it works:* It’s easy to answer, positive, and can lead to a genuine connection.**Important Considerations:*** **Profile Pictures:** Really analyze her pictures. Look for clues about her interests, hobbies, or travel destinations. This can provide valuable conversation starters.* **Be Respectful:** Even if she has a minimal profile, treat her with respect and avoid making assumptions or being overly forward.* **Don’t Be Discouraged:** It might take a few tries to get a response. Not everyone is active on dating apps or feels comfortable sharing a lot of information upfront.Ultimately, the best message is one that is genuine, engaging, and shows you’ve taken the time to look at her profile (even if it's brief!). Good luck! 3 Mensajes Efectivos para Enviar a una Mujer Sin Bio en una App de CitasHave you ever stumbled upon a profile on a dating app that's… sparse? Like, really sparse? No bio, maybe a couple of pictures, and you're left wondering, “Is this a bot? A ghost? Or just someone who believes in letting their pictures do the talking?”While a lack of information can be intriguing (a mystery!), it can also be a hurdle when it comes to sparking a connection. You don't have much to work with, so you need to be creative and strategic with your opening message.Here are 3 effective messages to send a woman with no bio on a dating app, along with explanations of why they work:**1. The Observational Opener**This approach focuses on something you *did* notice about her profile – her photos. It shows you paid attention and allows you to start a conversation based on shared interests or a vibe you picked up.*Example:* "Hey! Love the [location in one of her photos]. Been there myself! What’s your favorite thing to do in [location]?”*Why it works:* It's low-pressure, shows you’re observant, and provides an easy conversation starter.**2. The Playful Curiosity Approach**If you’re feeling a bit bolder, you can lean into the lack of information with a playful question. This shows you're not afraid to be a little cheeky and invites her to share something about herself.*Example:* "No bio, huh? Clearly, you're a woman of secrets. 😉 What’s one thing you’re surprisingly good at?”*Why it works:* It’s lighthearted, breaks the ice, and demonstrates a sense of humor.**3. The Direct & Engaging Question**Sometimes, simplicity is key. Ask an open-ended question that encourages her to elaborate and reveals a bit about her personality.*Example:* "What's one thing that's made you smile today?”*Why it works:* It’s easy to answer, positive, and can lead to a genuine connection.**Important Considerations:*** **Profile Pictures:** Really analyze her pictures. Look for clues about her interests, hobbies, or travel destinations. This can provide valuable conversation starters.* **Be Respectful:** Even if she has a minimal profile, treat her with respect and avoid making assumptions or being overly forward.* **Don’t Be Discouraged:** It might take a few tries to get a response. Not everyone is active on dating apps or feels comfortable sharing a lot of information upfront.Ultimately, the best message is one that is genuine, engaging, and shows you’ve taken the time to look at her profile (even if it's brief!). Good luck!](https://soulmatcher.app/wp-content/images/3-effective-messages-to-send-a-woman-with-no-bio-on-a-dating-app.jpg) 3 Mensajes Efectivos para Enviar a una Mujer Sin Bio en una App de Citas

Have you ever stumbled upon a profile on a dating app that's… sparse? Like, really sparse? No bio, maybe a couple of pictures, and you're left wondering, “Is this a bot? A ghost? Or just someone who believes in letting their pictures do the talking?”

While a lack of information can be intriguing (a mystery!), it can also be a hurdle when it comes to sparking a connection. You don't have much to work with, so you need to be creative and strategic with your opening message.

Here are 3 effective messages to send a woman with no bio on a dating app, along with explanations of why they work:

**1. The Observational Opener**

This approach focuses on something you *did* notice about her profile – her photos. It shows you paid attention and allows you to start a conversation based on shared interests or a vibe you picked up.

*Example:* "Hey! Love the [location in one of her photos]. Been there myself! What’s your favorite thing to do in [location]?”

*Why it works:* It's low-pressure, shows you’re observant, and provides an easy conversation starter.

**2. The Playful Curiosity Approach**

If you’re feeling a bit bolder, you can lean into the lack of information with a playful question. This shows you're not afraid to be a little cheeky and invites her to share something about herself.

*Example:* "No bio, huh? Clearly, you're a woman of secrets. 😉 What’s one thing you’re surprisingly good at?”

*Why it works:* It’s lighthearted, breaks the ice, and demonstrates a sense of humor.

**3. The Direct & Engaging Question**

Sometimes, simplicity is key. Ask an open-ended question that encourages her to elaborate and reveals a bit about her personality.

*Example:* "What's one thing that's made you smile today?”

*Why it works:* It’s easy to answer, positive, and can lead to a genuine connection.

**Important Considerations:**

* **Profile Pictures:** Really analyze her pictures. Look for clues about her interests, hobbies, or travel destinations. This can provide valuable conversation starters.

* **Be Respectful:** Even if she has a minimal profile, treat her with respect and avoid making assumptions or being overly forward.

* **Don’t Be Discouraged:** It might take a few tries to get a response. Not everyone is active on dating apps or feels comfortable sharing a lot of information upfront.

Ultimately, the best message is one that is genuine, engaging, and shows you’ve taken the time to look at her profile (even if it's brief!). Good luck!">

3 Mensajes Efectivos para Enviar a una Mujer Sin Bio en una App de Citas

Have you ever stumbled upon a profile on a dating app that's… sparse? Like, really sparse? No bio, maybe a couple of pictures, and you're left wondering, “Is this a bot? A ghost? Or just someone who believes in letting their pictures do the talking?”

While a lack of information can be intriguing (a mystery!), it can also be a hurdle when it comes to sparking a connection. You don't have much to work with, so you need to be creative and strategic with your opening message.

Here are 3 effective messages to send a woman with no bio on a dating app, along with explanations of why they work:

**1. The Observational Opener**

This approach focuses on something you *did* notice about her profile – her photos. It shows you paid attention and allows you to start a conversation based on shared interests or a vibe you picked up.

*Example:* "Hey! Love the [location in one of her photos]. Been there myself! What’s your favorite thing to do in [location]?”

*Why it works:* It's low-pressure, shows you’re observant, and provides an easy conversation starter.

**2. The Playful Curiosity Approach**

If you’re feeling a bit bolder, you can lean into the lack of information with a playful question. This shows you're not afraid to be a little cheeky and invites her to share something about herself.

*Example:* "No bio, huh? Clearly, you're a woman of secrets. 😉 What’s one thing you’re surprisingly good at?”

*Why it works:* It’s lighthearted, breaks the ice, and demonstrates a sense of humor.

**3. The Direct & Engaging Question**

Sometimes, simplicity is key. Ask an open-ended question that encourages her to elaborate and reveals a bit about her personality.

*Example:* "What's one thing that's made you smile today?”

*Why it works:* It’s easy to answer, positive, and can lead to a genuine connection.

**Important Considerations:**

* **Profile Pictures:** Really analyze her pictures. Look for clues about her interests, hobbies, or travel destinations. This can provide valuable conversation starters.

* **Be Respectful:** Even if she has a minimal profile, treat her with respect and avoid making assumptions or being overly forward.

* **Don’t Be Discouraged:** It might take a few tries to get a response. Not everyone is active on dating apps or feels comfortable sharing a lot of information upfront.

Ultimately, the best message is one that is genuine, engaging, and shows you’ve taken the time to look at her profile (even if it's brief!). Good luck!">

Por qué la gente se comporta mal en las aplicaciones de citas – Causas, Psicología y Soluciones">

Por qué la gente se comporta mal en las aplicaciones de citas – Causas, Psicología y Soluciones">

Por qué los hombres no hacen preguntas: Guía para una mujer soltera">

Por qué los hombres no hacen preguntas: Guía para una mujer soltera">

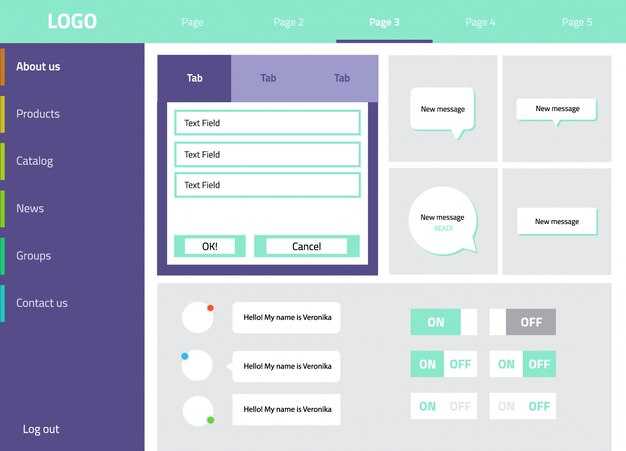

Ventana de diálogo – Diseño de la interfaz de usuario, ejemplos y las mejores prácticas de accesibilidad">

Ventana de diálogo – Diseño de la interfaz de usuario, ejemplos y las mejores prácticas de accesibilidad">

Superar la Codependencia – Consejos Prácticos para Liberarse">

Superar la Codependencia – Consejos Prácticos para Liberarse">